Trump wins! Is it a blessing or a curse for textile export companies?

At 1:40 a.m. Eastern Time on November 9, 2016, the results of the U.S. presidential election were announced. Trump won enough electoral votes (270 votes) to win this election. He will be the first real estate developer president in U.S. history who has no political experience.

After the news of Trump’s victory came out, the market crashed. The Mexican peso fell to a record low, and the U.S. dollar rose about 13% against the Mexican peso. USD/JPY fell more than 3.5%. It fell below the 102 yen mark.

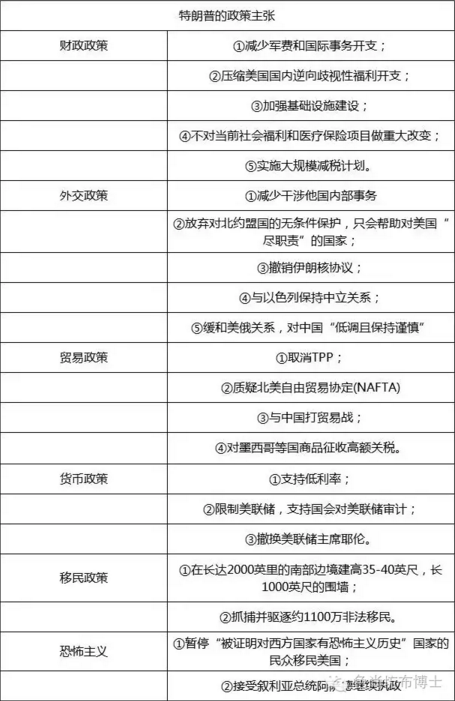

Trump’s main political ideas

From the above table, we can see that Trump’s coming to power will have a major impact on China’s foreign trade.

1. Tougher trade claims against China

Trump’s trade policy shows the relative restrictions of foreign trade policy and the tough attitude towards China’s trade, especially Trump’s previous Advocates the imposition of high tariffs on goods imported from China. From a long-term perspective, the trade protection policy may weaken the foreign trade profitability of Chinese companies, and the A-share market, especially the export sector (such as fabrics, mechanical and electrical industries), will face negative impacts in the long term.

When he was campaigning, he had two propositions that were mainly aimed at China:

, after being elected, he will order the Minister of Finance to designate China as a currency manipulator. Once it is determined that a country has exchange rate manipulation, the United States will not only put pressure on the country’s government through the IMF to adjust its exchange rate policy, but may also retaliate through trade measures such as taxing the country’s exports.

Second, if China does not cooperate with the United States, it will impose a 45% punitive tariff on all imported goods from China.

Kevin Lai, chief economist at Daiwa Capital Markets in Hong Kong, said that after Trump is elected, the U.S. trade tariffs on China may be increased from the current 4.2% Rising to 45% would cause China’s exports to the United States to fall by US$420 billion, or 87%. And this does not include the withdrawal of foreign investment. He estimated that under a 45% tariff scenario, export manufacturing is expected to move from China to the United States or other countries, bringing the scale of foreign direct investment (FDI) disinvestment to US$426 billion (about 3.91% of GDP). Even a 15% tariff on the low-end version will cost China 1.8% of its GDP.

2. A partial trade war between China and the United States may break out

A partial trade war between China and the United States may break out. If Trump is elected, although a full-scale trade war between China and the United States is unlikely to break out, in order to fulfill his campaign promises, he will definitely make some symbolic gestures and is expected to raise tariffs or set up barriers on some Chinese goods. China and the United States Trade friction will increase. Currently, the U.S. imports from China are mainly mechanical and electrical products. According to the U.S. Department of Commerce, the import volume in 2015 was US$237 billion, accounting for 49% of the total U.S. imports from China. Furniture, toys, fabrics and raw materials, and base metals and products ranked second, third, and fourth in the U.S. imports from China respectively. In 2015, the imports were US$55.61 billion, US$42.62 billion, and US$24.87 billion respectively, accounting for 10% of the US dollars. 12%, 9% and 5% of total imports from China.

3. Abandoning the TPP will be good for China

As we all know, Trump is an active supporter of opposing free trade, calling for bringing manufacturing and job opportunities back to the United States, and even threatened to Americans will withdraw from the WTO!

As an important part of the United States’ strategy of returning to Asia, the TPP is a mini-WTO with a total economic volume accounting for more than 40% of the economy. It excludes China, a major Asian economy, although the United States It has also adopted a posture of welcoming China to join the negotiations, but its original intention of starting the TPP was to contain China economically. Although the TPP is not a trade negotiation targeting the fabric industry, more than a dozen member countries attach special importance to the fabric field, especially the United States and Vietnam. Therefore, the agreement has attracted widespread attention in the fabric industry. The “zero tariffs” and “rules of origin” in the TPP rules have a great impact on industry exports.

Trump once publicly stated that he would not agree to the United States joining the Trans-Pacific Partnership Agreement (TPP), saying that the agreement was a betrayal of the American people and would It will expand the U.S. trade deficit and reduce U.S. manufacturing jobs. He believes that the agreement “is an attack on American business” and “a bad deal.”

If the United StatesBy withdrawing from the agreement, China would be spared the adverse economic impact of being excluded from the trade agreement.

Conclusion

This election has both advantages and disadvantages for the foreign trade exports of China’s fabric industry. Fabric companies should develop a stronger sense of crisis. Under the spur of any environment, our fabric companies must work harder to change, innovate, and accelerate, in order to ensure that orders are not completely transferred and leave room for survival for ourselves!

In addition to having a major impact on China’s foreign trade. Everyone should pay close attention to the risks of exporting to Mexico. Yesterday, the Mexican peso depreciated sharply by more than 10% against the US dollar, approaching a historical low.

AAASDFWFWFWE

Disclaimer:

Disclaimer: Some of the texts, pictures, audios, and videos of some articles published on this site are from the Internet and do not represent the views of this site. The copyrights belong to the original authors. If you find that the information reproduced on this website infringes upon your rights, please contact us and we will change or delete it as soon as possible.

AA